how to calculate pre tax benefits

Actual results may vary. How to calculate pre-tax health insurance.

Cost Of Debt Kd Formula And Calculator

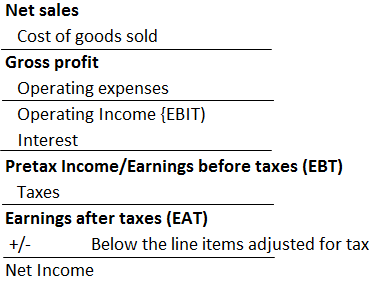

Pre-tax income often known as gross income is your total income before you pay income taxes but after deductions.

. Refer to the employees Form W-4 and the IRS tax tables for. And transportation benefits such as parking and transit fees. This calculator will show you just how much you are saving in taxes by making contributions to a Health Savings Account HSA.

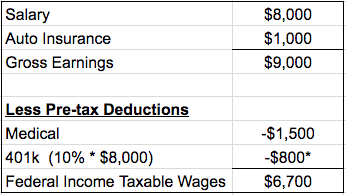

Her gross pay for the period is 2000 48000. Calculate the employees gross wages. 50000 30000 20000.

501c3 Corps including colleges universities schools hospitals etc. Then find the tax. Note that other pre.

Figure federal income tax by retrieving your allowances and filing status respectively from lines 3 and 6 of your W-4 form. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover taxes. In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and.

You calculate the pre-tax earnings by subtracting operating and interest expenses from your gross profit. 2000 300 1700. Adjust gross pay by withholding pre-tax contributions to health insurance 401k retirement plans and other voluntary benefits.

Go online and get a copy of IRS Circular E. A pre-tax deduction means that an employer is withdrawing money directly from an employees paycheck to cover the cost of benefits before withdrawing money to cover. The calculation would be.

In short with pre-tax benefits the benefit cost is deducted from an employees paycheck before income and employment taxes are applied. 403b Savings Calculator 403b plans are only available for employees of certain non-profit tax-exempt organizations. For example if you made 30000 last year and put 3000 in your retirement plan account on a pre-tax basis your taxable income for the year would have been 27000.

HSA Tax Savings Calculator. Actual Cost Of Pre-Tax Contributions. 10000 250 1800 1500 2500 16050 total deductible payments for year 1 16050 22 3531 annual deduction for year 1 3531 12 29425 monthly tax.

17000 X 765. The results provided are an estimate based on the information provided in the input fields. First indicate if you are.

What are pre-tax benefits. After deducting the health insurance premiums the employees pay is 1700. Divide Saras annual salary by the number of times shes paid during the year.

For example pre-tax deductions for retirement investment.

Are Payroll Deductions For Health Insurance Pre Tax Details More

What Are Payroll Deductions Article

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Profit Before Tax Formula Examples How To Calculate Pbt

Pre Tax Vs Post Tax Deductions What Employers Should Know

Nols Primer What Are Net Operating Losses

New To Pre Tax Benefits 4 Facts You Should Know Bri Benefit Resource

How Are Payroll Taxes Calculated Federal Income Taxable Wages Zenefits

Understanding Pre Vs Post Tax Benefits

Nols Primer What Are Net Operating Losses

Massachusetts Paycheck Calculator Smartasset

Pretax Income Definition Formula And Example Significance

How To Calculate Taxable Income H R Block

Pretax Vs Post Tax Tax Videos Video Chef Youtube

Pretax Income Formula Guide To Calculate Earnings Before Tax Ebt

Calculate How Much Can You Save With Pre Tax Commuter Benefits For 2020 Personal Finance Data